Two Ways to Help Break Down Barriers to Buying Life Insurance

By Kevin Cummer, Director – Life Products, TruStage®

Life insurance can help reduce anxiety and improve financial wellbeing. Here’s how to help members get the protection they need—especially in uncertain times.

As we hit the 18-month mark of the pandemic, life insurance is experiencing a bit of a paradox. According to the 2021 Insurance Barometer Study from Life Happens and LIMRA[1]:

American consumers seem to understand the value of life insurance

- 70% of Americans say they need life insurance

- 31% say they’re more likely to buy life insurance because of COVID-19

But purchasing behavior doesn’t align

- 52% of Americans own some amount of life insurance—a two-point drop from 2020.

- 40% of Americans—that’s 102 million adult consumers—say they have less life insurance than they know they need.

With nearly three-quarters of Americans saying they need life insurance, it’s clear most recognize the role it plays in their financial wellbeing. And the increased likelihood to buy because of COVID-19—which hits 45% for Millennial consumers—indicates consumers value life insurance in light of COVID-specific challenges.

So why the resistance? Higher unemployment levels are certainly part of the story. The Life Happens/LIMRA study showed 26% of survey respondents were worried about paying monthly bills and 21% had concerns about job security and their ability to maintain a steady income.

But employment is approaching pre-pandemic levels, while COVID-driven concerns around health and uncertainty remain. What can credit unions do now to turn awareness into action?

Here are two ways to help both the uninsured and underinsured.

Fight common misperceptions and empower members with knowledge

When it comes to life insurance, misperceptions abound—and some likely have a direct impact on purchasing. Here are a few of the most common misperceptions and key truths to educate members about.

- Life insurance is too expensive. The vast majority (81%) of the uninsured and 72% of the underinsured said cost was their top reason for not purchasing life insurance.

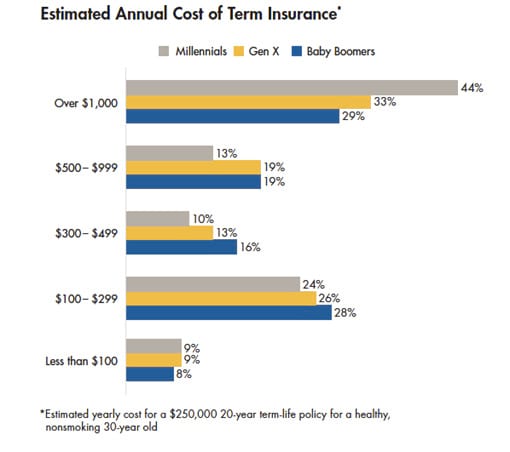

That’s especially disheartening given that the annual report from LIMRA has consistently shown consumers overestimate the cost of life insurance by a factor of three-plus. When asked what they expected to pay for a $250,000 term life policy for a healthy 30-year-old, over half of respondents thought a policy would be at least $500 a year. The true cost: closer to $165.

- Life insurance is just to pay for burial and final expenses. A surprising percentage of survey respondents believed this: 38% of Millennials, 28% of Gen Xers and 24% of Baby Boomers. The true range of life insurance benefits are many and include replacing lost wages and income, helping to pay off a mortgage, to transfer wealth and as a supplement to retirement income.

- I don’t need life insurance yet. A member might feel like they’re too young to worry about life insurance, but research from LIMRA found that 39% of those who had opted in for coverage wish they’d done it at a younger age. One important reason for members to buy sooner: the ability to lock in lower rates. Many policies can lock in rates for 20 or 30 years, making it especially valuable to sign up at a younger age.

Humanize the life insurance experience

It’s not uncommon for members to feel confused and overwhelmed by life insurance options.

After cost, here were the top five reasons for not purchasing life insurance:

- They didn’t feel they needed any. This could be a lack of understanding around all of the benefits of life insurance.

- They had other financial priorities. This likely has a strong correlation to the belief life insurance is more expensive than it actually is.

- They weren’t sure what type to buy or how much they needed. Members are looking for educational resources to help guide them through the process.

- They hadn’t gotten around to it.

- They didn’t like to think about death. Although it wasn’t mentioned in the 2021 LIMRA study, the 2020 study found that 30% of their survey respondents reported life insurance had been one of the leading topics for dinner table discussions. It seems reasonable to assume this conversation continued in 2021.

Recognize life insurance is an emotional purchase and that different racial and ethnic groups have varying attitudes around life insurance. Once you have that awareness, create tools and resources that reflect and address the concerns members face.

Help members protect the things that matter most

When it comes to protecting the people they love, it’s not that members don’t understand the value of life insurance, it’s that there are barriers in their way. Get to the heart of why they opt not to purchase, then humanize their experience. Once uncovered and addressed, their barriers become less of a hurdle and members can move closer to financial wellness. Your credit union plays a critical role in making that happen.

For more life insurance insights and trends, click here.

[1] LIMRA/Life Happens, “2021 Insurance Barometer Study”

TruStage® Life Insurance is made available through TruStage Insurance Agency, LLC and issued by CMFG Life Insurance Company. The insurance offered is not a deposit, and is not federally insured, sold or guaranteed by your credit union. Corporate headquarters: 5910 Mineral Point Road, Madison, Wisconsin 53705.

WHL-3722315.1-0821-0523 © CUNA Mutual Group

« Return to "Latest News" Go to main navigation