Virginia-Based CUs Added 1 Million Memberships in First Nine Months of 2020

CONTACT:

Lewis Wood

Vice President, Public Relations & Communication

800.768.3344, ext. 629

lwood@vacul.org

Virginia’s 115 member-owned added a million new memberships during the first nine months of 2020, according to information from the National Credit Union Administration, credit unions’ federal regulator.

Virginia’s 115 member-owned added a million new memberships during the first nine months of 2020, according to information from the National Credit Union Administration, credit unions’ federal regulator.

While the rate of membership growth slowed during the pandemic when compared to growth in previous years, growth was strong enough to push total memberships at Virginia-based credit unions to 14.7 million as of Sept. 30, 2020, up from 13.7 million at year-end 2019.

“2020 has been an incredibly trying year for many of Virginia’s families with the pandemic pushing unemployment to levels we haven’t seen since the height of the financial crisis and recession more than a decade ago,” noted Virginia Credit Union League President Rick Pillow. “But credit unions are stepping up to the challenge and members are finding they have a partner focused on their needs, not on profits.”

As not-for-profit, member-owned financial cooperatives, credit unions offer better rates on loans and savings products, and generally have fewer and less-costly fees than for-profit banks. Virginia’s credit unions provided an estimated $1.8 billion in direct financial benefits to their members during the year ended Sept. 30, 2020, according to estimates from economists at the Credit Union National Association.

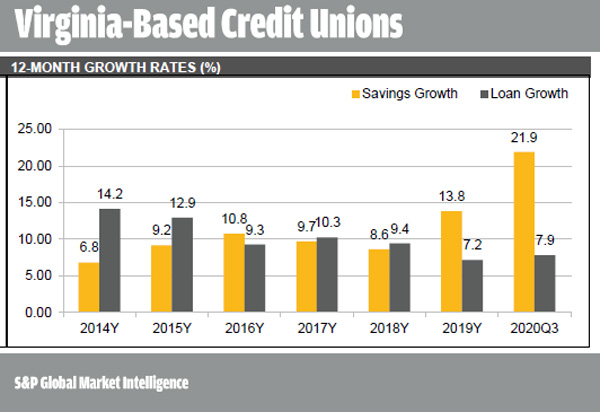

Owed to the pandemic, loan growth at Virginia-based credit unions has slowed in some categories, but remains remarkably steady overall, with mortgage and used auto lending posting solid growth above 10 percent during the year ended Sept. 30, 2020. Credit unions are a major player in the mortgage market, according Home Mortgage Disclosure Act (HMDA) data. U.S. credit unions funded $177.31 billion in home mortgages in 2019, a nearly 30 percent increase from the previous year, according to HMDA data.

In times of crisis, federally insured financial institutions, like credit unions and banks, generally see a significant uptick in savings and deposits, as consumers seek to build their savings nest eggs. The pandemic has been no exception.

Nationwide, government stimulus programs, tax payment delays and a slowdown in consumer spending fueled overall share and deposit growth of 8.3% on a quarter-over-quarter basis for the nation’s credit unions.

Funds deposited at Virginia-based credit unions into money market accounts, share draft (checking) accounts, IRAs and regular savings accounts have all seen significant upticks this year, with funds deposited in money market accounts leading that charge with growth rates above 9 percent in both the 2nd and 3rd quarters of 2020.

“Virginia’s credit union system remains strong and resilient, even as we continue to wrestle with the economic fallout of the pandemic,” said Pillow. “Credit unions continue to showcase the ‘Credit Union Difference,’ serving their members and communities with compassion and a commitment to the common good.”

About Virginia's Credit Unions

Virginia-based credit unions have assets totaling $198 billion and hold $134 billion in loans. They offer a full range of loan and savings solutions, with convenient branch access nationwide. Consumers seeking to join a member-owned credit union can visit yourmoneyfurther.com.

About the Virginia Credit Union League

The Virginia Credit Union League is the state trade association for the Commonwealth’s not-for-profit, member-owned credit unions. Through leadership, vision and the trust of our credit unions, the League is ensuring the growth, success and diversity of Virginia’s credit unions. Learn more at vacul.org.

« Return to "League News Release Archive" Go to main navigation