Regulatory Compliance Weekly Roundup: Sept. 15, 2023

Happy Friday everyone! It's been a busy week here at the League! We hiked the hill in Washington D.C. with many of our credit unions on Monday and Tuesday, meeting with our lawmakers to share the ways Virginia's credit unions are helping their members and discussing legislative priorities. We had a number of productive meetings with the banking aides of our legislators, as well as with Sen. Mark Warner.

Let's take a quick look at some stories this week from the Regulatory Compliance world:

NCUA

Yesterday the NCUA released its Q2 2023 State-Level Credit Union Data Report. This report comes on the heels of last week's Q2 Credit Union Data Summary. These reports share some insights on trends in lending, asset growth, delinquencies, charge-offs and more.

The national report aggregates data for the 4,686 federally insured credit unions in the U.S., and shows that year-over-year:

- Assets are up 3.8%, now totaling $2.2 trillion.

- Loans are up 12.6%, with total loans outstanding reaching $15.6 trillion.

- Insured shares are up 1.8% to $1.72 trillion.

- Net income is down $2.1%

- Interest income is up 45.3%, with non-interest income growing 4.9%.

- Delinquency rose 15 bps to 63bps. Most notable was the increase in credit card delinquency, which rose 47 bps from 1.07% to 1.54%.

- The credit union system's aggregate net worth ratio rose from 10.42% to 10.63%.

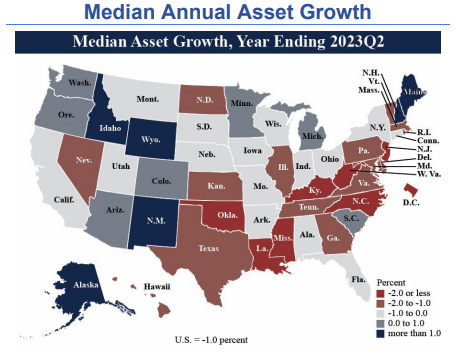

State-level data shows that while loans are growing at the median, assets, shares and deposits all decreased at the median. For assets, assets declined 1% at the median. In other words, half of all federally insured credit unions had asset growth of -1% or less.

The Quarterly U.S. Map Review shows where Virginia's median credit unions stack up against other states in several categories. You can find the Quarterly Map here.

The NCUA also announced their agenda for their upcoming Board meeting next Thursday. The Board will receive a quarterly briefing on the Share Insurance Fund and will issue a Final Rule on Financial Innovation – Loan Participation, Eligible Obligations, and Notes of Liquidating Credit Unions.

IRS

A few weeks ago we wrote about the IRS issuing a memo clarifying that federal credit unions could claim the Employee Retention Credit (ERC) for 2021 wages but not for 2020 wages. Credit unions aren't the only ones struggling with eligibility for this credit. This week the IRS announced an immediate moratorium on processing new ERC claims, which will run at least through the end of the year. The agency cited "rising concerns about a flood of improper Employee Retention Credit claims."

In comments, the IRS added their concerns about small businesses being "scammed by unscrupulous actors," referring to aggressive promoters marketing their ability to file claims on business' behalf. The IRS is urging any business being pressured by a promoter to apply for the credit to pause and review their situation, as well as work with a trusted tax professional.

That’s all for this week – I hope everyone has a great weekend, and we’ll be back with you next week!

« Return to "REGular Blog" Go to main navigation