Regulatory Compliance Weekly Roundup: November 3, 2023

Happy Friday! As we come down off our Halloween candy sugar highs and face the reality that somehow some Black Friday deals are already here, let's take a look at some headlines of the week in our world of credit union regulatory compliance!

NCUA

Late last week the NCUA released their proposed budget for 2024-2025. The budget calls for a 9.5% increase in total spending in 2024 and a net gain of 28 new positions. The proposal lays out details on what the new positions would do and provides a lot of information on the NCUA's operations and finances. The NCUA is funded by operating fees paid by credit unions, so any increases to their spending impact all credit unions. We are combing through the proposal and plan to submit feedback. Industry feedback is critical in this process. League President/CEO Carrie Hunt will be among the industry stakeholders testifying on the NCUA Budget at their November Board meeting, which will take place on Nov. 16.

Chairman Harper and Board Member Hood both spoke at NCUA's 2023 Diversity, Equity, and Inclusion Summit in Washington, D.C. this week. Chairman Harper stressed the importance of allyship in achieving DEI goals and advancing financial inclusion. Harper spoke about five essential elements of allyship: perspective, courage, action, reflection, and vision.

Board Member Hood stressed the importance of DEI and implementing DEI initiatives into daily operations. He highlighted the NCUA's recent proposed rule on Fair Hiring in Banking as an example of a leading-edge policy. He also urged the industry to continue the momentum it built in achieving DEI goals.

Board Member Hood followed up his remarks with an opinion piece in American Banker, again stressing the importance of the "Second Chance" Fair Hiring in Banking rulemaking currently under proposal.

CFPB

Late last week, the U.S. District Court for the Southern District of Texas issued an order expanding its initial injunctive relief in a court case involving the CFPB's Section 1071 rule. This rulemaking would require some financial institutions to collect additional data on applications for credit made by women-owned, minority-owned, and small businesses. The Bureau was sued by a bank and two banking trade associations over the rule. Earlier this year, the judge granted injunctive relief, meaning that CFPB could not enforce this rulemaking until the issue of whether the CFPB's funding structure is constitutional was resolved by the Supreme Court. However, the injunction only applied to the plaintiff bank and members of the plaintiff trade associations.

Credit unions quickly took action. CUNA, the Cornerstone League, and Rally Credit Union filed motions to be included as plaintiffs in the case and for the injunctive relief to be extended to credit unions. That request was granted last week, so now any credit union that is a member of CUNA or the Cornerstone League is protected by the injunction.

America's Credit Unions

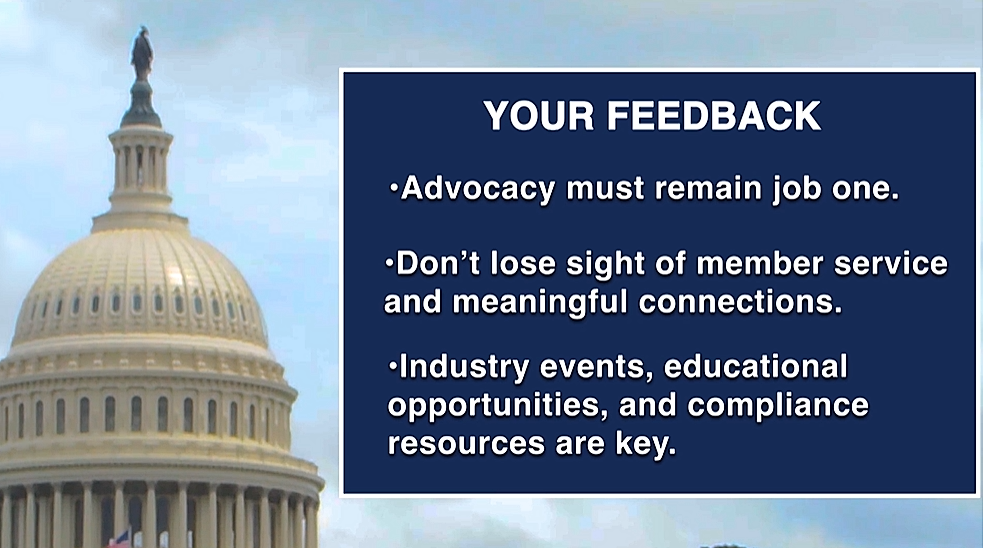

The big news of the week for credit unions was the announcement that members of CUNA and NAFCU voted overwhelmingly in favor of the merger of the two entities into America's Credit Unions. In a video announcing the results of the vote, NAFCU CEO Dan Berger summarized some of the feedback they had received when speaking with credit unions about the potential merger. Members stressed the importance of advocacy, member service, education, and compliance resources.

League President/CEO Carrie Hunt issued a statement on the merger, highlighting her vision for the new unified national trade and the Virginia League's commitment to advocacy, support, compliance, and a thriving credit union system here in Virginia.

That's all for now - enjoy the weekend, and don't forget to turn your clocks back on Sunday morning. "Fall back" means one extra hour of sleep!

« Return to "REGular Blog" Go to main navigation